The Beat Goes On: EC&M's 2017 Top 50 Electrical Contractors Special Report

Despite challenges in areas such as staffing, bidding, competition, and technological change, the nation’s largest electrical contractors stayed plenty busy in 2016, generating new highs in electrical and datacom revenue. While record non-inflation-adjusted revenue for the industry as a whole isn’t a new story line — it’s probably been logged annually since 2012 — that’s what the nation’s top electrical contractors achieved again in 2016.

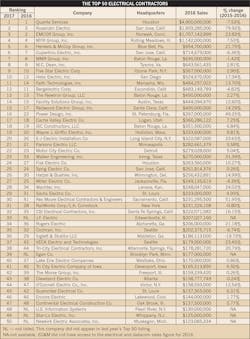

This year’s Top 50, a group ranked annually by self-reported revenue for the prior calendar year, raked in $1 billion more than they did in 2015. The group, which completed the annual EC&M survey on business conditions, recorded $23.8 billion in electrical and datacom services revenue (Fig. 1). That’s up from the $22.8 billion that the 2016 EC&M Top 50 pulled down in 2015, good for a second straight 4.4% gain.

The Top 50’s revenues have grown annually since 2010, when the impact of the financial crisis and recession was most acutely felt. Revenues for that year were $11.9 billion — a painful 10% slide from three years earlier. But since 2010, it’s been nothing but growth. Top 50 revenues grew steadily to reach $15.7 billion in 2013, and then bolted ahead to $21.8 billion in 2014. While some of that growth spurt might have been due to industry consolidation, the big getting bigger and large dollops of backlog clearance, some was surely due to a long-awaited business upturn. After 2014, revenue growth returned to the slow and steady pace seen in the mid-2000s, rising about 4% annually through last year.

Individual Top 50 contractor growth in 2016 was highly variable, likely reflecting at least some individual firm acquisition activity, but also location, size, market specialization, and other company-specific factors. Reported revenue performance for the year ranged from outlier highs of 79%, 52%, and 49% to a handful of declines — the worst being around 20%. For companies reporting growth, a plurality of about 35% logged modest, single-digit gains.

And once again, the Top 50 wasn’t static. While the top 10 was mostly stable, a fair number of companies in lower tiers traded spots. As in past years, a few new companies joined the club.

A balmy climate

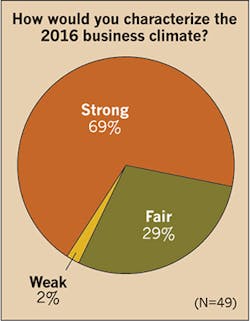

With revenues reaching an all-time record, and many individual companies likely experiencing record sales — positive assessment of overall business conditions by contractors reached a three-year survey high.

Nearly 70% of the Top 50 contractors chose the word “strong” to describe the 2016 business climate (Fig. 2). By comparison, 61% of last year’s Top 50 rated the 2015 climate as strong, and only half of the 2015 Top 50 described 2014’s atmosphere as strong.

A three-year, 20-percentage-point gain in what might be interpreted as contentment, optimism, or both seems bullish. But it could also be contrarian, signaling a market that is close to topping out — not unlikely given the long stretch of slow, uninterrupted growth in both the construction and broader economies. For now, though, leading contractors are enjoying the run, looking for fresh opportunities in a market that increasingly rewards innovation, preparation, efficiency, and cutting-edge know-how. But at the same time, they’re keeping a wary eye on trends that could disrupt their businesses and make it harder for them to meet the needs of demanding clients.

Revenue growth at Parsons Electric (No. 21), Minneapolis, mirrored that of the Top 50 as a group, rising to $283 million on the back of healthy demand in the data center, mission-critical, and health care markets, and increased client recognition of the company’s efforts to improve project delivery times and quality, says company president Joel Moryn.

“We’re getting picked for more jobs because of our expertise in the area of using lean construction principles, where we move more decision making to the field and commit to a schedule of what gets done each week,” he says. “Major general contractors are embracing this more, and it’s become a qualifier for getting projects in the health care and other mission-critical areas.”

But while he sees the business climate as strong, Moryn sees evidence of some softening in demand and is growing more alert to signs of recession. While healthy, the company’s backlog levels are getting harder to maintain, meaning that a slowdown could be in the offing.

“A year or two ago, we were able to book more into the future, and while the day-to-day stuff is strong, the big project opportunities are lagging,” he says.

The fruits of large-scale projects were in abundance, though, for Rosendin Electric (No. 2), San Jose, Calif. Payment for extended work on Apple, Inc.’s, huge campus in Cupertino, Calif., and other big jobs in coveted mission-critical and renewable energy sectors flooded in, propelling the company’s revenue for the year ahead by a Top 50-best 79%, to $1.959 billion.

“It was all organic growth, but we haven’t been growing at that pace — and we won’t do that again this year,” says Brian Brobst, director of preconstruction/corporate marketing. “A lot of it was contracts awarded in 2014 and 2015 that happened to hit in 2016.”

Though top-line growth will be harder to achieve in 2017, Brobst says Rosendin will find enough challenge and eventual reward in sustaining what has been built in recent years. He sees more big projects on the horizon, a result of the company rooting itself in markets that offer the kinds of challenging and extensive projects clients look to proven contractors to deliver.

“The programs we’re touching now are a lot different from four or five years ago; the scale is completely different, and they’re more complex in nature and size,” he says, adding that an expansion of geographical reach has accompanied the firm’s growing specialization.

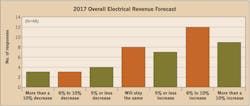

While neither Rosendin nor Parsons is forecasting increased revenues in 2017, they were in the minority. Sixty-one percent of the Top 50 — 28 companies — indicated that they were expecting an increase, while 20% are projecting a decrease. That mirrors the expectations of the 2016 and 2015 Top 50 players. However, near-term optimism has been scaled back some. Fifteen 2015 Top 50 companies predicted a coming-year increase of more than 10%; that was down to nine in this year’s Top 50 (Fig. 3).

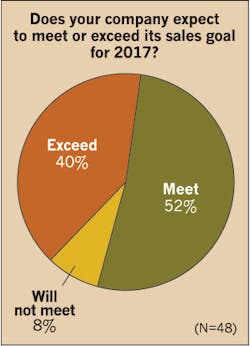

But pleasant surprises could still be in store for companies expecting a flat or down year. Last year turned out better than anticipated in terms of revenue for nearly half of the Top 50. Forty-seven percent of companies said revenue actually exceeded expectations in 2016 (Fig. 4), a sharp increase from just two years ago when only 31% said that was the case. But in a sign that executives might think business conditions could be growing more dicey, there was a slight falloff in the number of companies expecting they’ll meet their revenue goals. Nineteen companies said they expect some outperformance (Fig. 5) in 2017, compared with 22 last year. Yet it all adds up to generally bullish picture, with many contractors believing that times are good and demand for their services will grow.

Revenue at Rogers Electric (No. 34), Alpharetta, Ga., came in higher and is expected to grow more than 10% this year. Jason Hayes, vice president of sales and marketing, says the market for electrical services appears strong enough to raise firm revenues from $206 million to $255 million or more this year.

“We’re back into more cranes in the air,” says Hayes. “Things are nearly as good now as they were back in the 2004 to 2006 range, and I think it could be 2019 before we see a dip.”

The company grew its revenue 21% last year, taking advantage of strong demand in the retail buildings sector, Hayes says. One of the company’s biggest projects entailed electrical service, lighting, and ATM compliance upgrades at thousands of sites for two bank customers. The company also did more work in the educational/institutional market — one that it believes holds more opportunity.

“We look to the architectural services market for clues on construction market trends, and they’re still hiring,” he says. “We have some big ambitions for growth, and we’re in the fourth year of a five-year plan to double our business.”

Investments that O’Connell Electric Co. (No. 44), Victor, N.Y., made a few years ago in capital equipment needed to handle more electric utility sector work continued paying off in 2016. Two big jobs — a substation and a 12-mile transmission line for two customers that were worth a combined $40 million — helped propel the company’s revenue 13% to $159 million.

“Transmission and distribution historically has been 35% of our volume, but it was close to half last year, driven by those two jobs,” says CEO Victor Salerno.

This year, he says, the company is ahead of schedule on a goal of billing $200 million. An Erie Canal lock project, a wind farm in New York, and a growing list of solar projects that could be worth $6 million have kept the company’s backlog full and averaging around $180 million each month. With a line on expanded work in the gas fracking sector and a growing presence across the state, O’Connell is anticipating continued growth.

“Times are good for the industry, and, if you have a track record of completing work on schedule, it’s a wonderful time to be in construction,” says Salerno.

Profits pessimism

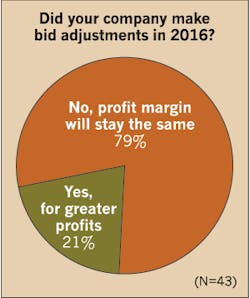

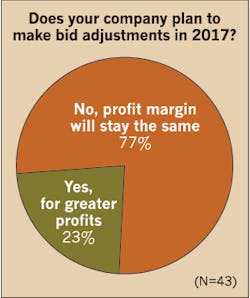

Despite more work and increased demand, contractor profit margins don’t appear to be moving appreciably, and expectations for a higher-margin environment may actually be fading. Just 21% of 43 contractors said they adjusted bids for greater profits last year (Fig. 6), down from 33% of the 2015 Top 50. And while 43% of the 2015 group said they planned to adjust bids for higher profits the following year, only 23% of this year’s group said they would (Fig. 7).

Revenues grew 6% to $157 million at Guarantee Electrical Co.(No. 45), St. Louis, but costs and competition are keeping a lid on profits, says president Doug Mertzlufft.

“Margins have yet to return to levels prior to the recession, and typically there are numerous qualified contractors bidding on projects,” he says, adding that pricing is squeezed by competition from more open-shop contractors.

One Top 50 company commented that competition is being heightened in his market due to the entry of “foreign-owned firms” and general and civil contractors expanding the scope of work to include electrical. But Encore Electric, Inc., (No. 46), Lakewood, Colo., has found a more favorable pricing trend in some of its markets. President Willis Wiedel says the company, whose revenues grew 2% to $144 million, has been able to selectively price more aggressively in markets where risks are higher and competition isn’t as fierce.

“It’s not that we’re necessarily adding more profit into our bids; it’s that the opportunity to get the margins we need is there,” he says. “We do more complex kinds of work in data centers, education, and laboratories that lend themselves to more profit. Some markets provide the opportunity to now get what we always believed we deserved.”

Ultimately, though, profits are increasingly a function of cost control and delivering value for the customer, says Brobst. A more intense value engineering approach at Rosendin is paying dividends and helping it cement itself in markets that deliver a better bottom line.

“It’s not easier to make a profit today; it’s probably harder,” he says. “Owners are more sophisticated, so you have to work harder on managing costs and planning workloads to sustain profits.”

Profits and hot markets don’t necessarily go hand in hand. Markets with growing opportunities obviously draw more interest, but a flood of contractors can mean more aggressive bidding and potentially lower margins. That reality has kept Continental Electrical Construction Co., (No. 47), Oakbrook, Ill., largely focused on markets that line up with its experience and expertise, which allows the company to avoid “chasing the top line,” according to vice president Steven Witz. Yet the lure of new markets and projects is growing for Continental, which boosted revenues 6% in 2016 to $138 million and is eyeing 10%+ growth in 2017.

“There are some new initiatives we’re going after, and we may try to adjust our margins there as we begin to understand them better,” he says.

Included on that list are data centers, an industrial sector it once moved away from, distributed antenna systems, and also renewable energy, which includes rooftop solar projects for the retailer IKEA.

“Mission critical is a growing market, and we’re looking to grow along with it,” he says. “It’s a natural for us because of the quality of work we do.”

Top markets solid

Continental isn’t alone when it comes to pushing into the data center and mission-critical space. Others continue to derive a fair share of business from the sector. The market once again was named as a leading contributor to prior year revenues for the Top 50 (Table 1), and was projected to be a primary source in the year ahead. Only health care was named by more contractors as a leading revenue source in 2017, once again (Table 2).

But in a diverse and growing economy, opportunities abound in a multitude of sectors for electrical contractors, especially as electrical infrastructure technology evolves and becomes more critical. Top revenue-producing markets reflect not only growth in the number of available projects but also in electrical scope and scale.

From its Silicon Valley base, Rosendin continues to ride growth in the data center, private office, and renewable energy markets. Technology company campuses have produced an especially large and reliable stream of work, and mission-critical applications show no abatement, says Brobst. A rising source of business is renewable energy, which is growing in the number of applications and the associated technology.

“Most of the work we do in that area is around solar arrays, in applications ranging from casinos to data centers,” he says. “A majority of the Fortune 50 clients are trying to incorporate renewables into their programs, and fuel cell work is growing also.”

Transportation is another market with growth potential. Though it garnered the fewest mentions as a top market in 2016, it took third place for projected 2017 markets, replacing private office.

O’Connell Electric’s Salerno sees continued opportunity in the transit market. It has performed airport and rail station work in multiple New York cities, and even sees lighting system opportunities growing in road projects. “Any mass transit projects involve a huge amount of electrical,” he says.

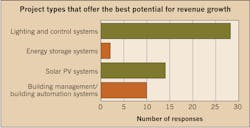

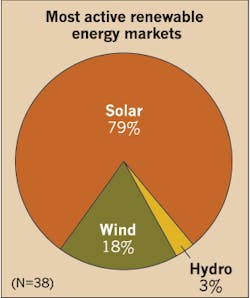

Lighting, of course, is a growing source of work for electrical contractors across many different markets. New installs, upgrades, and retrofits are incorporating more high-efficiency LED lighting at a faster pace, and control systems are becoming ever more sophisticated and capable. Such projects again were cited as the most active and promising in the commercial building market sector (Fig. 8). They handily beat out solar PV systems and building management/automation systems as building projects with the most revenue potential, but those two project types drew more mentions than last year. Solar is by far the most active renewable market among Top 50 participants (Fig. 9).

Mike Jurewicz, chief operating officer of Sprig Electric Co., (No. 25), San Jose, Calif., which had revenue of $262 million, says lighting projects are growing as a portion of private office work but demand more attention in design and installation because of California’s Title 24 rules on energy-efficiency improvements.

“Being a design-build firm, we have to understand the code requirements,” he says. “You can get burned badly if you don’t, so we have a group with the responsibility to design, install, and commission.”

Similarly, Parsons Electric is developing the in-house expertise needed to develop lighting and control systems and other elements of buildings that will increasingly have to be connected, sensored, controllable, and even energy self-sufficient.

“We’re developing cross-functional teams made up of technical people, AV estimators, and electrical project folks, looking at what’s available in terms of smart products and solutions,” says Moryn. “We want to make sure we’re able to meet the growing demand for things like low-voltage lighting and even Power-over-Ethernet lighting.”

Opportunities in the smart building space are also growing for Rogers Electric. The days of installing traditional light fixtures and switches are ending, says Hayes, which means knowledge of control systems products, design, and installation is becoming critical.

“The digital ceiling concept is one of the most important trends to watch,” he says, referencing the general concept of using a single converged IP network to control lighting and other building systems.

While technology advancements exert a push on contractors from the demand side, they also stand to impact how they deliver their services. Future revenue and profit growth are already being impacted by how they deploy and use information technology, and new frontiers in that area promise even more disruption. One is augmented reality (AR) and virtual reality (VR) technology embedded in headset hardware that allow users to alter their surroundings. Both have potential applications in design and construction: AR by enhancing reality with overlays of blueprints and designs; VR by delivering an experience that only appears and feels real to the senses (i.e., a building design mock-up).

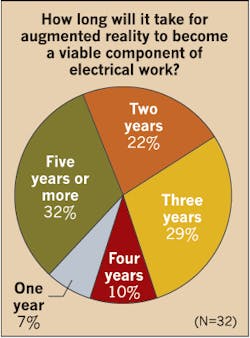

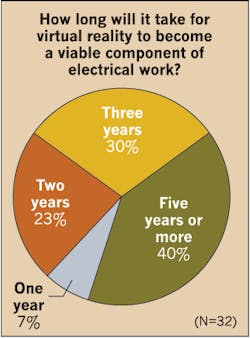

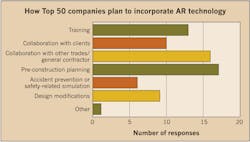

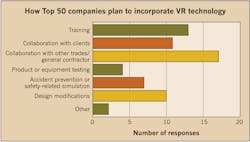

Both are in their infancy, but more construction designers and contractors are working with them, motivated by the prospect of improving a host of processes. The survey, though, revealed top contractors don’t look for AR or VR to take hold anytime soon (Fig. 10 and Fig. 11). The consensus is they’re at least three years out, but that they could improve collaboration, training, and pre-construction planning (Fig. 12 and Fig. 13).

“We’re doing things now I never thought possible,” says Continental Electrical’s Witz. “BIM modeling to help with design conflict resolution is here, and I think we’re closer than you might think to virtual reality tools and also robotics.”

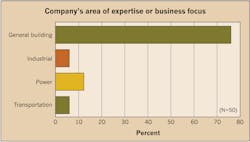

Technology’s evolution, of course, will take its own course — on its own schedule. In the meantime, electrical contractors have their hands full navigating a changing industry. But as the EC&M survey shows, business has been good for most, and the short-term growth outlook remains positive. As has been the case the last several years, the overwhelming majority of companies on the Top 50 list still work mostly in the general building category (Fig. 14), which includes commercial, institutional, health care, and housing work followed by industrial. Challenges loom though, and the industry will surely be tested again. The industry’s Top 50 continue to demonstrate that they’re willing, able, and even eager to meet the future head on.

Zind is a freelance writer based in Lees Summit, Mo. He can be reached at [email protected].

SIDEBAR: Labor Woes

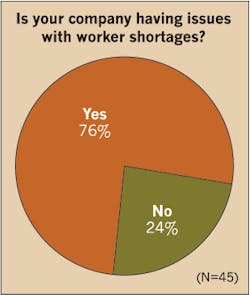

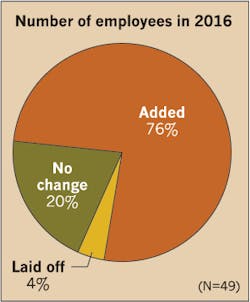

Personnel issues continue to dog the electrical contracting industry. In a repeat from last year, the 2017 EC&M survey of Top 50 contractors found three-quarters of participants are concerned about worker shortages (Fig. A). That’s worrisome because they’re mostly in hiring mode; three-quarters added employees in 2016 (Fig. B) and two-thirds said they wanted to hire in 2017 (Fig. C).

“There’s a significant challenge ahead to get people interested in this industry,” says Brian Brobst, director of preconstruction and corporate marketing for Rosendin Electric (No. 2), San Jose, Calif. “A whole layer of the workforce is retiring.”

Joel Moryn, president of Parsons Electric (No. 21), Minneapolis, says the company has been mobilizing to deal with a problem exacerbated by workers who abandoned the industry during the 2008 recession.

“A lot left and did not come back,” he says, “so we’ve had to add internal resources to go into high schools to generate some interest in the industry.”

The labor problem again drew by far the most commentary from Top 50 respondents about their primary business challenge. A sampling:

• “There are fewer qualified pros entering the industry than leaving.”

• “Skilled trades are not seen as viable careers vs. college.”

• “Growth will depend on how quickly we can recruit and retain the next generation of skilled workers.”

• “Skilled labor and project management will still be challenges. Construction is one place machines can’t replace people.”

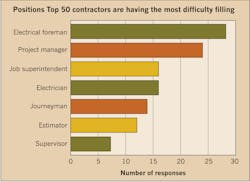

Project manager is one of top problem areas. Almost half of the Top 50 said it was a position they were having trouble filling. Only electrical foreman was named by more. Both positions shot up in mentions from last year’s survey, but estimator, job superintendent and supervisor were down (Fig. D).

Some contractors say worker shortages are holding them back. Jason Hayes, vice president of sales and marketing for Rogers Electric (No. 34), Alpharetta, Ga., says $255 million in expected revenues this year could be $300 million “if we had the right guys to complete the work.”

Mike Jurewicz, chief operating officer of Sprig Electric Co., (No. 25), San Jose, Calif., says worker shortages that are also a function of the Bay Area’s economy are impactful. “If we had the manpower, we could grow 15% to 30% this year.”

Some companies are working harder to keep the employees they have. “Retention is a bigger item for us,” says Willis Wiedel, president of Encore Electric, Inc., (No. 46), Lakewood, Colo. “If you hire, train, and lose them, that’s a problem.”

The company is investing more in both job and safety training, hoping it will cause prospects to join and stay with the company, Wiedel says.

Indeed, as shortages loom and jobs grow more complex and demanding, worker training becomes more important. And evidently it’s an area of growing need. Top 50 players singled out the National Electrical Code (NEC) and LED/intelligent lighting as areas where employee training is needed the most (Fig. E).

About the Author

Tom Zind

Freelance Writer

Zind is a freelance writer based in Lee’s Summit, Mo. He can be reached at [email protected].