Piggybacking on a boom in construction, energy infrastructure modernization, an energy efficiency push, and perhaps even a post-election surge in optimism, electrical systems designers are predictably enjoying good times now — and are modestly hopeful they’ll last.

Distilling results of EC&M’s most recent annual size ranking and business-conditions survey of leading electrical design firms, companies are riding a wave of sorts, enjoying the experience but aware that staying on top requires some deftness, skill, and foresight.

As a group, companies on the 2017 EC&M Top 40 Electrical Design Firms List, ranked by the prior year’s electrical design services revenue, reported growth for the third straight year, cracking the $2 billion mark. Many sound a cautiously bullish note, indicating that overall business is strong, near-term prospects for growth are good, and that they’ll have to staff up to meet the expected demand for their services — albeit in an especially challenging market for design talent.

Electrical design-services billings in 2016 for this year’s Top 40 firms, a group that includes four that were not on last year’s list, totaled $2.15 billion, a 15.6% increase from the $1.86 billion in revenue reported by last year’s top companies, and 28% higher than the $1.68 billion the year before. What’s even more astounding is this group’s tally is 60% higher than the combined revenues reported by those in the 2013 Top 40 report.

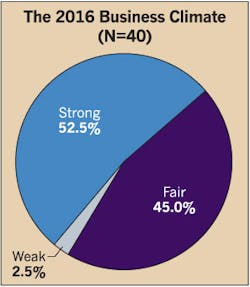

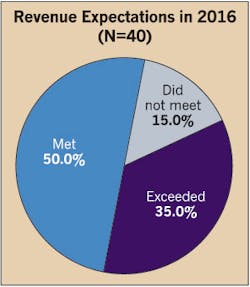

But despite the revenue uptick, just under half of the Top 40 respondents chose the word “fair” to characterize 2016’s business climate (Fig. 1). While about 45% rated it so, down two percentage points from the previous year, a still notable 53% said “strong” was the right word. Also, basically mirroring the 2016 Top 40, 35% said revenues exceeded expectations (Fig. 2).

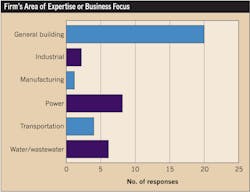

With all but six firms on the list reporting revenue increases, 2016 was a respectable year for most of the Top 40, half of which primarily serve the general building market (Fig. 3). Individual revenue gains ranged from fractional to near 85%, though the reported numbers don’t strip out gains attributable to mergers or acquisitions.

Hot markets don’t cool

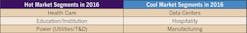

But executives at some firms say the gains were again hard-won, coming in a more competitive market whose evolution continues to demand adaptability, cutting-edge expertise and the ability to spot and seize opportunity in hot and emerging sectors. Those, for the third straight year, were health care, education/institution, and power (see the Table). Design activity in those markets has been relentless and consistent for designers, reflecting a mix of rising demand, demographics, a quest for innovation, and adaptation to a broadly changing energy environment.

Lackluster markets, meanwhile, continue to shift. Sectors identified most often as slow for 2016 were data centers, hospitality, and manufacturing. In 2015, it was government, oil/gas, and residential that were sluggish, while private office, retail and residential topped the 2014 list of laggards.

Electrical design revenue at Burns Engineering, Inc., (No. 17), Philadelphia, grew to $24 million in 2016, a 39% increase partly attributable to robust demand in the transportation market.

“We certainly had big year-over-year growth, and that was the result of momentum in the markets that we’re in,” says COO/EVP John Burns.

One big area was aviation, he says, where terminal modernization and airfield lighting and navigation projects are blossoming. The other was rail, where government safety mandates for Positive Train Control systems is one development fueling demand. The company also was more active in the energy systems market in the Northeast, where interest in load management and resiliency via microgrids and smart control technologies is growing.

“We’re constantly thinking about what external influences can do to our markets, but we try to focus on those that offer growth opportunity and have some barrier to entry,” Burns says.

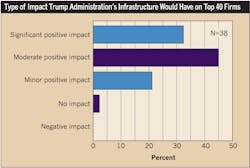

One variable that could boost its fortunes, and that of many fellow Top 40 firms, is eventual fulfillment of a Trump campaign pledge to shepherd a $1 trillion national infrastructure improvement program. If it happens, the Top 40 see this having a positive impact on their business, a third saying it would be significant (Fig. 4).

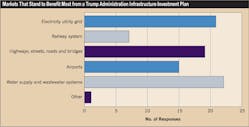

That will depend on individual design firm business focus, though, since much of it could be hard infrastructure such as roads and bridges. But a plan could also entail improvements in sectors with big electrical components. Almost half the Top 40 think the electric utility grid and airports would be beneficiaries of this type of national plan (Fig. 5).

“There’s no question we’re in the infrastructure business and transportation, sectors that rely on state, local, and federal spending,” says Burns. “I’d love to see the regulatory environment improve and for those projects to come to fruition.”

Like Burns, Affiliated Engineers, Inc., (No. 12), continued to benefit in 2016 from being in markets that demand special expertise. Especially active in education/institution, research lab and health care systems design, the Madison, Wis.-based company grew its revenue by 17%, to $33 million.

“Our core markets are technically complex ones that have been strong for us for many years,” says Krista Murphy, an electrical engineering principal at the firm.

Another factor that contributed to sales growth last year was the company’s continuing commitment to cementing a reputation as one that advocates for quality design, Murphy says. Affiliated designers prioritize discussions about not letting concerns about cost and speed overshadow performance and functionality, an approach that helps gain the confidence of owners.

“We have an opportunity to bring the quality discussion into the early phases of the design process so it can’t be value-engineered out at a later date,” she says.

Sustaining revenue growth also requires an ability to readily adapt to changing market structures, something Burns & McDonnell (No. 1), Kansas City, Mo., saw play out even more in 2016 on its way to revenues of $712 million. John Olander, president of the company’s electrical transmission and distribution group, says the firm is having to work with new players in that market, a primary source of electrical design revenue. While traditional electric utilities remain the dominant customer, the steady growth of distributed power generation assets is bringing more merchant- and developer-owned power into the market.

“That’s required us to begin moving to a different client set where the project cycles are faster, there’s less standardization, and more ability for us to deliver projects to our own standards,” Olander says.

Looking ahead, though, Burns & McDonnell is not sure what to make of the overall prospects for revenues from the power and electric utility sector due partly to a lack of clarity on the energy regulatory and policy front. That uncertainty ultimately could feed into a slowdown in the company’s rate of electrical design revenue growth, which it predicted to be on the order of 5% or less this year.

Staying positive

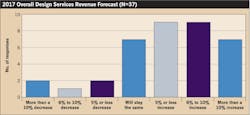

About one-quarter of the Top 40 share a similar prediction of modest revenue growth in 2017. Another quarter see a chance of a 6% to 10% increase, while one-fifth see 10% or more in the cards. Few see a decrease, while seven respondents see revenues unchanged this year (Fig. 6).

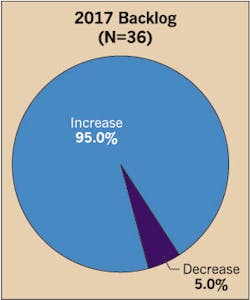

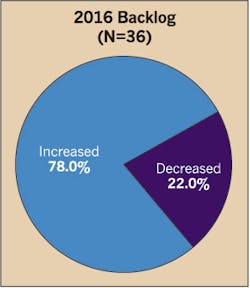

On another gauge of optimism and overall business conditions, nearly all respondents predicted their backlog would increase this year, most by 10% or less (Fig. 7). That was also the case in last year’s survey, but as it turned out only about three-quarters of this year’s Top 40 said their backlog increased during 2016 (Fig. 8). And in a sign business might be slowing, that reported backlog figure is down; in last year’s survey 87% reported backlog increases during 2015.

At Commonwealth Associates, Inc., (No. 8), Jackson, Mich., demand from its well-cultivated transmission and distribution market is expected to keep designers busy and support revenue growth in the range of 6% to 10% this year, following 12% in 2016, says president Dennis DeCosta. The need to replace aging infrastructure and develop innovative design solutions for integrating more renewable power in the system bodes well for long-term growth as well, but DeCosta understands the folly of claiming any certainty.

“On the surface, our crystal ball says this will be a robust market for five to 10 years,” he says. “But there was the same feel about this time in 2001, and less than two months later Enron hit and the bubble burst. Historical data also suggests 2017 as a year of potential downturn. Typically, we see six or seven years of boom followed by one to two years of belt tightening.”

Depressed fossil fuel prices have eaten into the design business of firms that serve the once-on-fire oil and gas industry. One, Stantec, Inc., (No. 2), Edmonton, Alberta, sees little prospect for appreciable rebound in market prices and thus continuation of slack demand for design services in the sector.

To counter that, Senior Principal Kevin Rettich says the company continues to cultivate other markets and explore diversification through acquisitions; the latter, he says, accounted for a fair chunk of the firm’s reported 39% electrical design revenue growth in 2016. It is getting deeper into the buildings systems market, and the purchase of MWH Global last year gave it a bigger stake in the growing water resources market.

“If oil and gas prices remain where they are, we won’t see growth on the energy side of our business this year,” he says. “But we’re finding that the buildings and sustainable energy markets are ones we can maybe grow.”

Despite challenges, Stantec padded its backlog by at least 15% last year. Rettich won’t make a prediction for its direction in 2017, but thinks it will surely be impacted by staffing resources. “If we’re not able to react as quickly, that will increase our backlog,” he says.

Stubborn staffing concerns

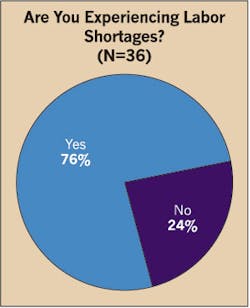

Stantec was among the 76% of firms that said, once again, they’re finding it hard to fill open job positions (Fig. 9). That’s worrisome on many levels, and it’s a topic that, like last year, dominated respondent commentary on firms’ greatest business challenge of the coming year. Staffing gaps clearly impact the ability to bid on jobs, expand into new markets, and control labor costs. And it’s evidently problematic because the Top 40 are in hiring mode; 70% said they added employees last year, and about the same percentage expected to increase their payrolls in 2017.

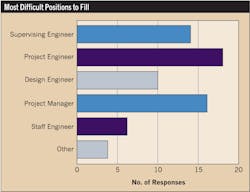

Apparently eager to pursue more business while opportunities abound, systems designers find themselves especially hamstrung by a dearth of experienced engineers who have central roles in getting work in, and out, the door. More respondents said project engineers and project managers were the hardest positions to fill, perhaps an indication that they’re viewed as especially key slots because they entail not only technical expertise, but important communication and project management duties as well (Fig. 10).

At CDM Smith, (No. 25), deeper client and multi-discipline design team interaction, enabled with the emergence of more virtual design tools, is putting a premium on the collaborative aspects of design. The Boston firm places a high value on associates who communicate well with clients, a skill that’s often closely linked to experience. But, like many other firms, says Technical Strategy Leader David Tucker, CDM is struggling to find experienced engineers.

“New skill sets are needed to work with emerging technology, and communication is a very important piece of our industry,” he says. “But anyone with a moderate amount of experience is a hiring challenge.”

Design firms blame accelerating Baby Boomer retirements, stiffer competition for talent, and fewer newly minted electrical engineers for the staffing challenges. The problem may work itself out over time, but for now many companies indicate a lack of seasoned designers leaves them exposed.

Faith Technologies, Inc., (No. 32), Menasha, Wis., added about 20 designers in 2016 to handle more work that led to a 24% revenue gain, but is nagged by the difficulty of finding more senior-level people. It’s bracing for at least a 10% decline in design revenue this year, but sees a long-term growth trend.

“The big challenge is finding the more experienced engineers, supervisor level or higher, who can run projects and do client interaction,” says Tom Clark, EVP of preconstruction.

New design challenges

Experience, though, may only go so far in today’s electrical design world. In fact, it might be a hindrance in a field that’s being upended by far-flung technological advances such as digital communications, renewable energy, battery storage, and sensors. Younger and newly minted engineers, while lacking practical experience, are more reliably equipped with the electrical systems knowledge set vital to designing in the 21st century.

Indeed, designers see a future that might intrigue a new generation of electrical design professionals. Assessing revenue growth opportunities at their firms, the Top 40 signaled a subtle shift toward more next-generation types of commercial building projects.

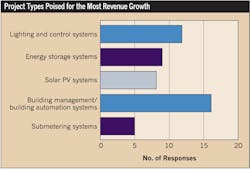

Four distinct project components — energy storage, solar PV, building management/automation, and sub-metering systems — gained slightly in mentions from the previous survey, largely at the expense of lighting and control systems (Fig. 11). Whereas 18 of the 2016 Top 40 said lighting and controls were a growth driver, the number dropped to 12 this year. That could indicate lighting projects are now seen as a mature category, although innovation and deployment there is far from exhausted.

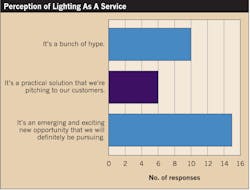

One driver of lighting project growth could be the lighting-as-a service (LaaS) model that structures lighting upgrades as a lease of sorts and outsources acquisition, design, ongoing maintenance, and future upgrades to a third party paid partially with lighting system energy savings.

Should LaaS take firmer root and spur more projects, designers could conceivably see a higher volume of lighting design work. But the Top 40’s views on it remain split. One-quarter says it’s just talk, but half say it has promise. Six designers said it was a practical solution they’re pitching to customers, half the number reported last year. But 15 characterized it as an opportunity worth pursuing (Fig. 12).

Building projects that revolve around lighting or some other aspect of energy efficiency could drive growth at P2S Engineering, Inc., (No. 33), a Long Beach, Calif.-based firm where revenue climbed 33% and could top 10% this year. A likely source of future growth, says vice president Aravind Batra, will be the California mandate for net zero energy buildings. Batra says government (and eventually commercial buildings) will need complex systems overhauls to comply. Building controls, submetering, plug load controls, and renewable energy will play a role.

“Money will have to be spent as they move toward a 2030 deadline for state-owned facilities, and we’re preparing for it with a new dedicated net zero energy group,” he says.

But lighting and controls projects still challenge designers, and remain fuel for growth. Jim Sattem, a principal with Interface Engineering, (No. 24), a Portland, Ore.-based firm whose design revenue grew 9%, says there’s still a big untapped market for upgrading to improved building lighting, and room for designers to help clients untangle its growing complexities.

“We’re now getting down to addressable devices and not just zone control, so it’s an ever-evolving market,” Sattem says. “But no two systems are the same, and we have to design ones to meet client needs. No one wants to be on the bleeding edge.”

Renewable energy opportunities

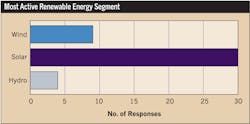

But that may not be the case when it comes to integrating renewable energy into commercial building projects. Eight Top 40 designers said solar PV systems offer growth potential in that space; it garnered four mentions by last year’s Top 40. And, in general, designers are far more active in solar projects than they are in wind or hydro in the renewable energy applications space (Fig. 13).

For now, incorporating on-site power into new or building upgrade projects remains a fringe consideration in electrical design. But as building energy efficiency and resiliency become a bigger consideration, off-grid power sources, including renewable power, are certain to play a role. Solar PV is the primary source, and one whose growth could be turbocharged with advances in energy storage — another building project type cited for its growth potential.

The mechanism for tying buildings into solar energy sources is likely to take the shape of microgrids that incorporate multiple facilities. An example is a project that P2S was involved in at the University of California-San Diego campus. Batra says the company helped design a SCADA system and other control and power transmission components for the microgrid, which includes 1.2MW of solar PV in addition to non-renewable generation.

“There’s a trend for more large campuses to seek to improve reliability and incorporate on-site generation, including solar PV,” says Batra. “We’re trying to position ourselves to help lay out that infrastructure.”

Broadly defined energy efficiency considerations continue to find their way into systems designers’ work. All but four Top 40 companies said their projects are based to some degree on energy efficient design. The average firm says “green” is a factor in about 40% of its projects. It amounts to about half at Faith Technologies, which is more deeply involved in microgrid work that includes solar and building energy efficiency improvements driven by corporate green initiatives.

“The microgrid concept is going to be the next big trend in the electrical design business, with industrial companies that want to be off the grid by 2030 needing reliable and cheap power,” says Clark. “And it’s all about design.”

“Green” comprises only about 10% of the work at Burns Engineering, but it’s likely to grow as energy usage reduction becomes a standard consideration in more projects. The company has partnered with some energy services companies (ESCOs) on LEED-type projects and has contributed to designs on commercial projects that touch on efficiency considerations.

“Commercial buildings in the Philly Naval Yard redevelopment project looked to energy storage and submetering to lower energy costs, and an airport project used submetering to help control energy use by multiple tenants,” says Burns.

At Stantec, interest in energy management is growing so much that the hiring of a dedicated sustainable design leader is on the table, says Rettich. About half of the company’s work addresses some element of energy efficiency, Rettich reckons, and a growing part of it has a connection to advanced building controls that help save energy. He doesn’t detect a groundswell of interest in LEED-certified buildings, but rather some level of sustainable design that building controls ultimately impact.

Future promise

Building controls could be revolutionized by the emergence of an Internet of Things (IoT) initiative that would bring broader interconnection, sensor-based monitoring, and wireless communications of systems into sharper relief. The IoT is something systems designers are watching with ever more interest, but a lack of clarity on what it means forestalls much detailed planning. Still, just over half of the Top 40 — and five more than last year — agree it’s inevitable and slowly working its way into business strategies (Fig. 14).

Burns & McDonnell’s Olander says the IoT will at some point blossom as a natural outgrowth of a mounting hunger for real-time information and analytics.

“These technologies are being brought to bear in new facilities, but what’s more difficult is going into systems of facilities built long ago and trying to retrofit them,” he says. “People want information, and they want it now. But that will take time.”

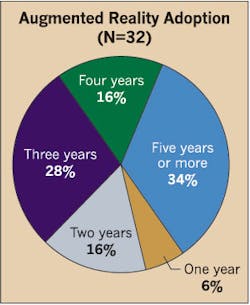

Another potentially disruptive technological advance that’s slowly working its way into the design world is augmented reality (AR). AR is a variation of CAD that overlays a hypothetical design onto an existing real-world environment, producing a more vivid, contextual view of prospective changes. Byproducts may include faster design work, improved collaboration and lower labor costs, all appealing outcomes for electrical design firms. But few among the Top 40 see using it anytime soon. More than 75% say it’s at least three years away from making an impact (Fig. 15).

But CDM is one designer that says it’s basically here now. The company has used the technology on a few projects, Tucker says, and is excited about AR’s ability to improve transparency and head off troublesome problems that can arise in the construction phase.

“It’ll be important with electrical work because we’re often combining large pieces of equipment and very small conduit and wires, and you need to know if changes will affect what was intended or something already designed,” he says.

AR may be a ways off from changing how electrical designers work — and the IoT may take years to take root — but the future is never too far away for the industry to grow complacent. As the EC&M Top 40 survey reveals once again, design firms — a full and diverse community of them — are seizing opportunity now, but also taking the full measure of a future that’s as complicated and complex as it is promising. As electrical systems become ever more critical to the operation and maintenance of the physical infrastructure, opportunity will abound for designers who know their markets, stay on the cutting edge, nab the best talent, and leverage technological advantages.

Zind is a freelance writer based in Lees Summit, Mo. He can be reached at [email protected].