A recent survey from Prime Advantage, a Chicago-based buying consortium for midsized industrial manufacturers, shows that industrial manufacturers are prepared for another tough year in 2009, but that they are counting on the conservative measures taken over the past few years to help carry them through to better times by year-end.

According to Prime Advantage’s Group Outlook Survey, 87% of respondents expect to introduce new products in 2009, even as 62% are expecting some level of revenue decline in 2009. And even as most raw material costs continue to drop, managing these costs continues to be a top priority for manufacturers that are coping with varying degrees of revenue shortfalls.

Survey data was collected in late February from 103 representatives of industrial manufacturing companies, including business owners, vice presidents of procurement, and purchasing professionals.

Twenty-eight percent of respondents expect revenue to stay the same as 2008, while 6% expect revenue to increase up to 10% and just 3% expect an increase of more than 10%. Among the 62% who anticipate revenue declines, 37% of these reported they expect revenues in 2009 to decrease up to 10% in comparison to 2008, while a further 25% expect revenues to decrease more than 10%.

This is in agreement with other business indexes, such as ISM data, which shows the PMI stuck in the mid-30s for the past three months, and with U.S. Department of Commerce trade data that shows the export of U.S. manufactured goods fell 20%in January 2009 as compared to 1 year earlier.

A full 66% said capital spending for U.S. locations, including significant capital improvements or new purchases of property or equipment, is expected to decrease from 2008 levels. This is nearly identical to the responses garnered from Prime Advantage’s Group CFO Survey that was conducted in January, when 69% of manufacturing CFOs said they expected cutbacks in capital improvements this year.

Another 34% percent expect capital spending to be equal to or more than 2008 spending amounts.

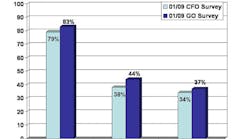

The top external concern facing manufacturing is customer demand at 83%. Credit markets and interest rates was the next greatest concern, with 44% reporting, and volatility of the dollar came in as the third most frequently listed concern at 37%. Again, the top external concerns mirrored the results of Prime Advantage’s Group CFO Survey, where the inability to measure customer demand ranked as the top external concern at 76%, while credit markets and interest rates came in second (38%) and volatility of the dollar came in third (34%).

For the third Group Outlook Survey in a row, raw material costs (such as metals and plastics) are the top cost pressure concern, as cited by 67% of survey respondents. This has come down since the last survey, when 93% mentioned it as the top cost pressure concern in July 2008.

Overhead costs ranked as the second greatest cost pressure at 50% (up 39% from the July 2008 Group Outlook Survey, when it was cited by just 11% of respondents). Logistics/supply chain costs continue to rank among the top three concerns, with 49% in agreement.

Other cost pressure concerns in 2009 include healthcare (43%), energy (27%), foreign competition (27%), inflation (25%), and labor (23%).

Although there is great concern about the costs of raw materials, 93% of the respondents still expect raw material prices to continue falling over the next six months. A majority expects similar results for the price of components (72%) and supplies (56%).