Electrical contractors, specifying engineers, and other electrical professionals who depend on the construction market for a living may one day fondly look back on the past few years as “the good old days.” Most construction market niches and regions of the United States have bounced back from the depths of the Great Recession from 2007 to 2009 and enjoyed several years of steady, but not spectacular, growth. Get ready for a change of pace, as many economic indicators point to a construction market growing a bit slower than it has over the last few years.

Most of the sources we spoke with for this construction forecast special report aren’t suggesting anything catastrophic, but they do expect a noticeable slowdown in 2020. However, all business is local, and every city or geographic region of the United States, as well as each of the key segments of the construction market, will have a different economic story to tell next year.

Some project types have really stood out over the past few years — data centers, airports, light rail, ports, liquid natural gas (LNG) projects along the Louisiana-Texas Gulf Coast, wind farms, and “live-work-play” mixed-use developments built either downtown or in the suburbs. These projects have provided many electrical contractors and design and specification professionals with some lucrative business opportunities and should continue to do so in 2020.

On a geographic basis, metropolitan areas that recently enjoyed particularly strong construction markets include Boston, New York, Miami, Dallas, Houston, Austin, San Antonio, Chicago, Denver and Colorado’s Front Range, Los Angeles, San Diego, San Francisco, Seattle, and Washington, D.C. The residential market in Phoenix remains hot, and while Texas’ Midland-Odessa region has had several crazy-busy years related to a booming oil business, in recent months that market has slowed.

THE NATIONAL VIEW

While most construction economists believe 2020 will usher in an era of decelerated growth, there’s a surprising amount of space between some of the forecasts for key segments of the market. In the American Institute of Architects (AIA) Consensus Construction Forecast for 2020 in the area of nonresidential construction — one of the most important drivers of the electrical economy — forecasts from a group of well-known construction economists mark a wide channel of slow growth from -0.4% to +4.4%. The AIA, Washington, D.C., blended these economists’ forecasts for a 2020 consensus nonresidential forecast of +2.4% growth. The AIA Consensus Construction Forecast averages the forecasts of eight leading construction forecasting firms — Dodge Data & Analytics, IHS Economics, Moody’s Economy.com, FMI, ConstructConnect, Associated Builders and Contractors, Wells Fargo Securities, and Markstein Advisors.

Their forecasts for the closely watched industrial market show an even wider channel of expectations, from +0.1% to +9.1% growth. AIA’s consensus forecast for this segment comes in at +3.3% growth for next year. ConstructConnect’s +9.1% industrial forecast at the high end was an outlier, as the other forecasts are much closer to the AIA consensus forecast for this segment.

The closely watched Dodge Construction Outlook says total U.S. construction starts will slip to $776 billion in 2020, a decline of -4% from the 2019 estimated level of activity (See Table 1).

“The recovery in construction starts that began during 2010 in the aftermath of the Great Recession is coming to an end,” said Richard Branch, chief economist for Dodge Data & Analytics, in a press release announcing its 2020 forecast. “Easing economic growth driven by mounting trade tensions and a lack of skilled labor will lead to a broad-based but orderly pullback in construction starts in 2020. After increasing +3% in 2018, construction starts dipped an estimated -1% in 2019 and will fall -4% in 2020.”

However, he maintains that next year will not repeat what the construction industry endured during the Great Recession. “Economic growth is slowing but is not anticipated to contract next year,” he continued. “Construction starts, therefore, will decline but the level of activity will remain close to recent highs. By major construction sector, the dollar value of starts for residential buildings will be down -6%, while starts for both nonresidential buildings and nonbuilding construction will drop -3%.”

At the annual 2020 Dodge Construction Outlook Conference, held October 30-31 in Chicago, economists and construction industry speakers on the various conference panels offered additional insight on what they expect to happen in the overall U.S. economy as well as on each of the most important niches of the construction market. One of the key takeaways from the event was that the most important segments of the 2020 construction market are off their recent cyclical peak in 2018 but don’t appear to be poised to drop back to anywhere near recessionary levels next year.

Cristian deRitis, deputy economist for Moody’s Analytics, said that although the probability of a recession increased over the past 12 months, key macroeconomic variables put the odds at approximately 20%, while the financial variables that he tracks reflect a better chance, but still less than 50/50. According to deRitis, consumers are “driving what little growth there is in the economy” right now. An economic indicator of concern is the fact that businesses are not making capital investments in their operations.

Neither deRitis nor Branch believe key economic indicators point to a downturn anywhere near what the economy experienced in 2007 to 2009 during the Great Recession. However, Branch agreed with deRitis that the lack of business investment is a problem. He also said the tension over trade negotiations were the “No. 1 risk” to the economy.

“Soft data suggests that trade tensions and the uncertainty causing them are causing businesses to pull back or cancel investments,” he told the crowd of construction industry executives at the Marriott Downtown Chicago Renaissance Hotel, adding that the U.S. economy will probably slow down to approximately 2% growth by the end of the year. “We don’t see the U.S. economy entering a recession in 2020 — a slowdown yes; a recession no,” he said.

Branch said contractors are not worried about finding construction jobs, but that they are having a hard time finding workers. He estimates a record 375,000 jobs are currently open in the construction industry. With electrical contractors typically employing 13% of all construction workers, that means an estimated 48,750 electrical jobs are vacant.

“We think the lack of available labor will put a serious crimp in the economy and in the contractor market,” said Branch.

KEY MARKET SEGMENTS TO WATCH

Let’s now look at where the largest segments of the construction market are headed next year: single-family; multi-family; office; commercial; health care; educational; manufacturing; and power. Together, these segments account for 63% of total construction put-in-place, per FMI Corp.

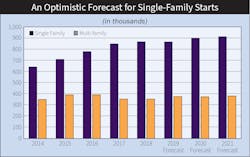

Single-family homes. In many local markets, it has been tough for homebuilders to find qualified workers, reasonably priced building lots, and buyers for entry-level, single-family homes. The National Association of Home Builders (NAHB), Washington, D.C., is forecasting a +3.8% increase in single-family housing starts next year to 902,000 units (see Fig. 1). FMI is forecasting a +1% increase next year in single-family construction activity and says this segment will account for 21% of all construction put-in place next year. Branch isn’t as optimistic and said single-family housing construction, a leading indicator of future market conditions, peaked in 2018 and will see mild declines in 2019 and 2020 of -3% and -5%, respectively.

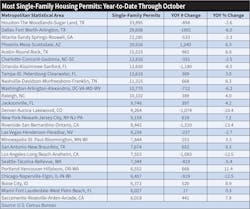

Although interest rates are super-low right now, he said the cost of single-family homes is outpacing what Millennials can afford in many markets. This age demographic of 23- to 38-year-olds is a huge potential customer group for entry-level, single-family homes, and when they enter the market, they will have a very positive impact on it (see Table 2 for information on the MSAs with biggest YTD increase in single-family building permits).

Multi-family. The more cyclical multi-family segment of the housing market, which according to FMI data will account for 5% of all construction in 2020, has sizzled in cities like New York, Boston, Miami, Dallas, Seattle, San Francisco, and Washington, D.C., as demand for luxury condos loaded with the latest technology in lighting control, security, home theater, and home automation systems created all sorts of business opportunities for electrical contractors and design and specification professionals. Multi-family construction has also benefitted from the demographic trends of aging Baby Boomers moving into 55 and over communities and other types of senior housing. The trend of Millennials buying condos because they either can’t afford or don’t want to live in single-family homes out in the suburbs has also supported multi-family construction.

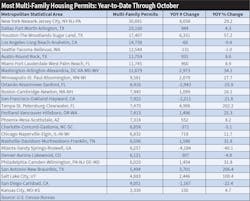

Branch says the multi-family housing market peaked in 2018. Although he expects declines of -11% in 2019 and -15% in 2020, this housing niche was riding along at a high level and was enjoying several of its busiest years since the Great Recession. Over the past few years, multi-family housing data has been skewed by an unprecedented explosion of activity in New York and some other metros. According to Dodge Data, through the first nine months of 2019, New York had $12.9-billion worth of multi-family housing construction, more than double that of Washington, D.C., which was in second place. Los Angeles and Miami rounded out the top four markets for multi-family housing (see Table 3 for information on the MSAs with biggest YTD increase in multi-family building permits).

Offices. Office construction is expected to peak in 2019 after several years of steady growth and decline -2% in 2020 to $50.1 billion. Dodge expects the dollar value of office construction to grow +6% in 2019 to $50.9 billion, as it has lagged other construction categories. Key to its recent growth has been the construction of new corporate headquarters over the past few years, including Toyota in Plano, Texas; Apple in Silicon Valley; and Amazon in downtown Seattle.

Over the past few years, there has been an amazing amount of office construction in a relative handful of markets. Houston, Dallas-Fort Worth, and Austin, Texas, have had a huge impact on the overall office market. According to a post on www.bisnow.com about a report by the CoStar real estate consulting firm, “CoStar data shows Texas’ top three office markets — Houston, Dallas-Fort Worth and Austin — housed roughly 104-million square feet of the 430-million square feet of new U.S. office space that came online during the last decade. In total, Dallas-Fort Worth, Austin and Houston accounted for 24% of the nation’s new office construction pipeline during the 10-year span running from 2009 onward.”

Office construction, which accounts for an estimated 15% of all nonresidential construction and 6% of total construction, according FMI data, has been steady on a national basis and doesn’t appear to have been as reliant on speculative building that often fuels boom/bust construction cycles. For some local markets that rely on various tech industries (such as Silicon Valley and San Francisco, Seattle, Austin, and Dallas), the construction of new corporate headquarter buildings has provided contractors and other electrical professionals with the opportunity to work on once-in-a-lifetime trophy jobs.

Institutional. Although the educational and health care segments that make up the bulk of the construction industry’s institutional market have not grown as much as the segments mentioned above over the past year or two, both are expected to show better growth in the short-term future. Dodge Data & Analytics is forecasting construction spending increases in the educational and health facility segments of +2% and +3%, respectively. AIA’s Consensus Construction is looking for similar low single-digit growth in these segments, forecasting the health and education segments to grow 3.7% and 4.4%, respectively, in 2020.

Construction of new schools in the K-12 market has been sluggish in recent years because of struggles with public financing and declining enrollments in some market areas. However, in faster-growing Sunbelt metros, this key market segment is still strong. Take Texas, for example. The suburbs surrounding cities like Houston, Dallas, Austin, and San Antonio are poised to see a renewed influx of K-12 construction because of the passage of school bond issues. According to the School Bond Center Report published by American School & University, one of EC&M’s sister publications, 47 separate bond issues for a total of $6 billion in school construction funding were passed by Texas school districts in the last year.

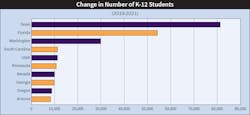

If you have an interest in the school construction market in your local area, keep an eye on trends in school enrollment through the free data published by the National Center for Education Statistics at https://nces.ed.gov.datatools. As you can see in Fig. 2, Texas is expected to gain 81,400 new K-12 students from 2019-2021 — far more than any other state.

Manufacturing. According to Dodge Data & Analytics, the dollar value of manufacturing plant construction will slip -2% in 2020 following an estimated decline of -29% in 2019. Rising trade tensions has tilted this sector to the downside with recent data, both domestically and globally, suggesting the manufacturing sector is in contraction.

Commercial. Dodge Data & Analytics’ forecast data for this category covers the construction of stores, warehouses, offices, hotels, and garages/service stations. Its forecast calls for a -6% decline in 2020 to $119.5 billion based on a -13% decline in warehouse construction by Amazon and other retailers. According to Dodge Data, over the past four years, Amazon invested a whopping $5.7 billion in the construction of its massive fulfillment centers, which often hit $200 million in total construction costs and cover over 2-million square feet.

Power. Dodge Data & Analytics’ 2020 forecast is calling for its electric utilities/gas plants category to drop -27% in 2020 following growth of +83% in 2019, when several large LNG export facilities and new wind projects broke ground.

IN SUMMARY

While you can expect the national electrical construction market to slow down in 2020, there will still be plenty of opportunities for growth in select market segments and local geographic areas. However, competition to hire qualified skilled labor to work on new projects will continue to be intense and may hold back new construction starts.

SIDEBAR: MEASURING GROWTH IN YOUR LOCAL MARKETS

This article offers a national perspective on the trends that will have the most impact on the 2020 construction market. But as we mentioned in the main text, all business is local for many small- to medium-sized contractors and design firms.

Local market data is available from the federal government, state economic development agencies, and other sources. It can help you analyze the market conditions in your local area and compare how a county, metropolitan statistical area (MSA), or state is doing compared to the national growth averages for the same metrics. Local indicators of interest to EC&M readers are:

• Electrical contractor employment

• Industrial employment

• Building permits

• Population growth

• Gross metropolitan product (GMP) and gross state product (GSP)

• Oil & gas rig count (for companies doing business in oil or gas market areas)

You can use this data to analyze local market conditions on a monthly, quarterly, or annual basis. Here’s some information on where to find these economic indicators.

Electrical contractor & industrial employment (www.bls.gov). The U.S. Bureau of Labor Statistics updates this data on a monthly basis at the MSA, state, and national level and twice annually at the county level. Employment data can swing quite a bit from month-to-month, so you may want to use a three-month moving average to smooth out the variances.

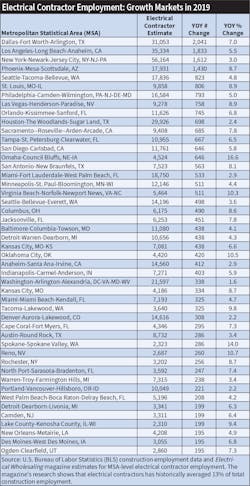

You can learn quite a bit from this data. For example, when you look at the national numbers, at 967,233 employees at electrical contracting companies through September 2019 (three-month moving average), contractor employment is riding along at one of the highest levels in recent memory, despite the softening U.S. economy.

Note: BLS doesn’t publish electrical contractor employment data at the MSA level, so we developed our electrical contractor estimates by taking the total construction employment data available monthly at the MSA level and multiplying it by 13% ― the historical average for national electrical contractor employment as a percentage of total construction employment.

This employment data also shows you the consolidated nature of electrical contractor employment in the United States. The Top 10 markets in electrical contractor employment account for 23% of all employees, and the 100 markets with the most electrical contractor employees account for 69% of all contractor employment (see Table 4 for data on the 25 largest markets as measured by electrical contractor employment).

Building permits (www.census.gov/construction/bps). Building permits are a good leading indicator of future economic activity in a market because of the impact new residents have on the local economy. With new homes comes the need for more schools, new retail and commercial facilities, and virtually all other types of non-residential construction. As you can see in Table 3, Texas and Florida dominate the list of residential housing markets with the most single-family permit activity.

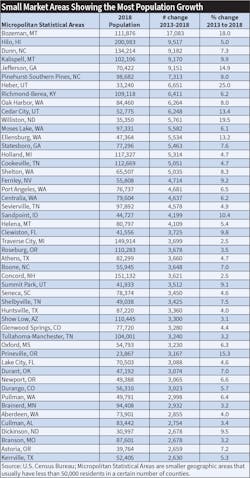

Population growth (www.census.gov). You will see some familiar names amongst the MSAs in Table 5, which showed the biggest increases in the number of new residents from 2013 to 2018. Leading this list are the Dallas-Fort Worth-Arlington, Texas, MSA with 722,193 new residents and the Houston-The-Woodlands-Sugarland, Texas, MSA, which added 666,727 new residents. As shown in Table 6, Bozeman, Mont. and Hilo, Hawaii led the list of smaller metros, with increases of 17,083 and 9,517 new residents, respectively.

The MSA population data also shows just how fast Texas is growing. According to U.S Census data for population growth from 2013 to 2018 the Dallas, Houston, Austin, and San Antonio metros added a staggering combined total of 1,626,371 new residents over the past five years.

Gross metropolitan product (GMP) (www.bea/gov). Published at the MSA level annually by the U.S. Bureau of Economic Research, this data gives you a sense of how fast a local market’s total economy is growing. Another good source for this data is the U.S. Metro Economies report, published annually by the U.S. Conference of Mayors and the Council on Metro Economies and the New American City. It’s available at www.usmayors.org. Only the fastest-growing MSAs hit 4% in real GMP growth. This report forecasts that in 2019, some markets at this level include Coeur d’Alene, Idaho; Myrtle Beach-North Myrtle Beach-Conway, S.C.-N.C. and Spokane-Spokane Valley, Wash. Interestingly, the report doesn’t expect any MSAs to hit 4% in real GMP growth in 2020. As a point of reference, the 2019 figure for U.S. real GDP is 2.1%.

Oil/gas rig counts. If your local market’s economy relies on the oil & gas industries, you can get weekly updates on the number of rigs operating by state or oil/gas basin from Baker Hughes at https://rigcount.bakerhughes.com/na-rig-count.

Hot Local Metros: What They Have in Common

For most EC&M readers, this is where the rubber meets the road. The national data at the 35,000-foot level discussed in the main text of this article is good for an overview on the overall direction of the market and is an important point of comparison, but local market conditions vary wildly from the national level. We find that much of the growth on the local level can be found in metropolitan statistical areas (MSAs) that fit one of the following profiles.

The big dogs. Metros with more than 2 million residents expected to add population the fastest over the next few years. Houston and Dallas are leading the pack right now.

Growth belts. Economically supercharged regions. Raleigh-Durham, S.C.; Austin-San Antonio, Texas; San Jose-San Francisco; and Colorado’s Front Range (Colorado Springs north through Denver and Boulder to Fort Collins and Greeley) are examples of regions that seem to always be on the fast track.

The oil & gas economies. Midland-Odessa, Texas led the nation by many growth metrics in recent years, but the rig count has slowed down some there and in Oklahoma. Other areas to watch are New Mexico and North Dakota’s Bakken/Williston Basin. In the gas markets, the three biggest basins are the Marcellus (Ohio, Pennsylvania, and West Virginia); Haynesville (Louisiana and Texas); and Utica (Ohio and Pennsylvania).

Tech is tops. Silicon Valley-San Francisco; San Diego’s biotech patch; Boston; Seattle; and Austin, Texas, are still growing fastest.

Stars of the Sunbelt. Big-time population growth continues to drive residential and commercial markets in multiple MSAs in Florida, South Carolina, North Carolina, Texas, and Arizona.

Swinging high and low. Cyclical metros that can be blazing hot or scary-bad. Dallas; Houston; Orlando, Fla.; and Phoenix are super-busy right now, but they can hit the skids in tough times.

Vacation land, lifestyle, retirement havens, & nirvana for telecommuters. Bozeman, Mont.; Bend, Ore.; Boise, Idaho; St. George, Utah; Myrtle Beach, S.C.; and Southwest Florida bank on the leisurely lifestyles they can offer to attract new residents and businesses.

Ports, freight rail lines, and intermodal hubs. Port construction and investment in rail lines and intermodal hubs drive growth in these MSAs. All the larger ports, including Long Beach-Los Angeles; Houston; Oakland, Calif., and New York-New Jersey have benefited from this trend. Activity in some smaller ports, like Savannah, Ga., also is strong.

Small but mighty. Metros with less than 500,000 residents showing all the signs of big-time growth. See vacation/retirement/lifestyle metros.

About the Author

Jim Lucy

Editor-in-Chief, Electrical Wholesaling & Electrical Marketing

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling, Electrical Marketing newsletter and Electrical Construction & Maintenance magazine on topics such as electric vehicles, solar and wind development, energy-efficient lighting and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas. In 1999, he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in communications and a bachelor’s degree in journalism from Glassboro State College, Glassboro, N.J. (now Rowan University) and studied electrical design at New York University and graphic design at the School for Visual Arts.