Mergers & Acquisitions of Electrical Contracting Firms Are on the Rise

Electrical contracting firms could be rising as hot properties in the mergers & acquisition (M&A) and private equity arenas.

Against a favorable backdrop that includes a growing electrification and decarbonization push, growth of the economy’s service sector, demographic shifts, and aging company ownership, electrical specialists in both the services and engineering and construction spaces could find themselves appealing targets for more buyouts, conglomerate building efforts, and infusions of cash seeking potentially high and stable returns.

The evidence isn’t coming from news of blockbuster deals but more from increased chatter in the mergers and acquisitions world about trends: An FMI Capital Advisors report on the 2023 M&A outlook for construction services that sees more activity in the commercial and industrial electrical space due to the attractive and growing end markets it serves; a posting from Liberty Mutual Business Insurance noting growing private equity interest in general or specialty contractors to create entities with broader reach and growth opportunity; a Friendly Home Services Group piece noting surging interest by private equity in electricians and other residential services providers that offer important target profile characteristics like extensive industry fragmentation, strong organic growth prospects, and robust recession resistance.

The FMI piece says electrical contractors are attractive targets because they’re exposed to the emerging “new economy” driven by growing and sustained investments in transformative sectors like datacenters, life sciences, electrified transportation, sophisticated industrial structures, distributed power, and semiconductor fabrication. Unique exposure to that economy through “established relationships across attractive, growing end markets,” combined with the growing push for electrification “will make contractors and services providers with skilled electrical labor forces attractive acquisition targets.”

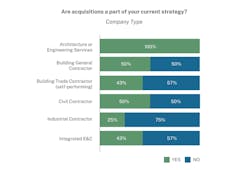

Another FMI report from 2022 on trends in engineering and construction M&A emphasizes the growth of renewable energy as a deal driver for the sector. It finds a market ripe for more deals involving infrastructure designers, developers, builders, and service providers that rely heavily on electrical expertise (see Figure below). “Renewables-focused engineering, procurement and construction (EPC) companies have been popular targets for buyers,” and “as you follow the electron further down the value chain, we see energy efficiency service providers and mechanical, engineering, and plumbing (MEP) services firms continuing to combine across many end markets as the ability to vertically integrate and serve the holistic needs of a client from planning a project all the way through ongoing service gains popularity.”

Much of the dealmaking involving electrical contractors has yet to play out, says FMI Managing Director Ryan Foley, an author of the construction services M&A outlook report. The broad M&A market has stalled so far this year, and no major deals in the electrical space appear to be in the offing, he notes. But with a clear rationale for deals and a template of sorts in place — firms such as Archkey Solutions, Emcor Group, and MYR slowly building electrical contractor empires and private equity firms like CAI and Huron Capital taking stakes in electrical contractors — the electrical contractor sector is likely in for more disruption.

“Profit margins are good in that space, and when you’re doing north of 25%, that will always attract interest,” Foley says. “And with more money flowing into sectors that that industry is active in, driving growth, private equity firms are going to look at acquisitions.”

There are more willing sellers, too, Foley adds. More aging Baby Boomers at the helms of contractors are looking for suitors, as the nature of the business evolves to adapt to advances in technology and challenges like labor grow more acute.

But any big move toward more deals might have to overcome barriers that have long kept many acquirers leery of investing in the construction and contracting space.

“Construction has always been a tough industry for M&A,” Foley says. “Its cyclicality, requirements for bonding, unions, and poor economies of scale are barriers, and it’s a tough business in which to double or triple a company’s size. That makes for a much smaller universe of buyers.”

Tom Zind is an independent analyst and freelance writer based in Lees Summit, Mo. He can be reached at [email protected].

About the Author

Tom Zind

Freelance Writer

Zind is a freelance writer based in Lee’s Summit, Mo. He can be reached at [email protected].