When you dig deeper into economic factors with the biggest impact on business conditions in the electrical construction market, you soon uncover one central challenge that influences most others — inflation.

Inflation does seem to be slowly moving in the right direction after rising to levels not seen in decades during and shortly after the COVID shutdown. But if it stalls at current levels, the challenges electrical contractors are currently having with higher product prices (Table 1), the slowdown in spending on construction projects or business expansion because of higher borrowing costs, and tough times in the housing market because of higher mortgage costs will continue. The higher interest rates could also tamp down demand for the stocks of publicly held electrical manufacturers, distributors, and contractors.

Despite concerns over inflation, construction industry economists, many Wall Street analysts, and some senior electrical executives don’t see a recession in 2024. Nick Lipinski, an equities analyst with Vertical Research Partners (VRP), who manages a quarterly survey on electrical marketing conditions with Electrical Wholesaling, EC&M’s sister publication, says while distributor survey respondents don’t see a recession in 2024, some mentioned a slowdown. He said several respondents saw less day-to-day activity in October, but agreed projects already underway will be seen to completion.

“It’s too soon to tell if this is merely a temporary pause or the start of a more meaningful deceleration,” he said. “We have heard in prior quarters about soft spots of a week or two that turned out to just be air pockets in between spurts of still-strong demand.

“Some distributors have also seen a slower quoting environment, though others still see a healthy pipeline related to reshoring and/or stimulus-related investments. Looking forward, distributors are expecting sales down 1.6% on average for Q4 2023, the first anticipated decline since 2020.”

To get a sense of the market climate design firms and electrical contractors can expect in 2024, let’s take a look at the core segments that will provide many of the business opportunities: the residential and industrial markets, office and mixed-use construction, hospitals, data centers, schools and universities, renewables, and the utility market.

Modest growth in nonresidential construction

While Dodge Construction Network is looking at 3% growth in the key nonresidential sector in 2024, the company’s economists still have concerns for future growth because of interest rates and borrowing costs. “Risks continue to mount for the construction sector,” said Richard Branch, chief economist for Dodge Construction Network, in a recent press release. “Over the last 12 months, construction starts have essentially froze as rates increased and credit tightened. The industry needs further adjusting as rates are expected to stay higher for longer, along with the potential for higher energy costs and continued political uncertainty. A return to broad-based growth in construction starts is still some time away.”

In her analysis of the most recent Dodge Momentum Index data, a leading indicator for future construction activity, Sarah Martin, associate director of forecasting for Dodge Construction Network, said in a press release, “Solid demand for data centers, life science labs, and hospitals supported the uptick in nonresidential planning activity last month. While month-to-month trends can be volatile, year-to-date trends show an overall decrease in commercial planning, offset by more institutional projects entering the queue. If financial conditions improve in early 2024, steady planning activity should follow.”

Several other construction forecasters issued cautious outlooks for 2024 growth. ConstructConnect said it expects total U.S. construction starts to contract 8.1% in 2023 but return to growth of 2.8% in 2024. But its autumn 2023 quarterly forecast said, “Nonresidential building activity is not expected to return to growth in 2024, but levels of construction activity are high relative to historic averages. The medium-term outlook is positive with support from the Inflation Reduction Act (IRA) and the CHIPS Act (Creating Helpful Incentives to Produce Semiconductors). The bumper growth in 2022 means that the 2023 growth rate will be negative due to large projects falling out of the calculation, while capacity constraints are likely to weigh on activity in 2024, causing a slump of 1.9%.”

The Deloitte consulting firm also sees federal legislation sparking growth in 2024. It said in its 2024 Engineering & Construction Industry Outlook, “Looking ahead to 2024, there could be a boost to construction associated with manufacturing, transportation infrastructure, and clean energy infrastructure, as funds from three key pieces of legislation passed in 2021 and 2022 — the Infrastructure Investment and Jobs Act (IIJA), the IRA, and the Creating Helpful CHIPS Act — are expected to flow into the industry.”

One of the most interesting construction forecasts available is the Consensus Construction Forecast published twice-a-year by the American Institute of Architects. It blends the forecasts for key construction niches from nine leading construction economists at the following companies: Dodge Construction Network, S&P Global Market Intelligence, Moody’s Analytics, FMI, ConstructConnect, Associated Builders & Contractors, Wells Fargo Securities, Markstein Advisors, and Piedmont Crescent Capital. AIA’s forecast expects nonresidential construction spending to increase just 2% next year after a 19.7% boost this year, supported in large part by a 55.1% increase in industrial construction spending.

In his July 2023 commentary on the updated 2023 Consensus Construction Forecast, Kermit Baker, AIA’s chief economist, said spending on nonresidential buildings has been growing at a “torrid” pace so far this year. “Even with the expected moderation during the second half of the year, the AIA Consensus Construction Forecast Panel is projecting that spending will increase by just under 20% for the year,” he said in his analysis. “That pace of growth hasn’t been seen since the construction boom years leading up to the Great Recession. Leading the charge is the manufacturing sector, where spending is projected to increase more than 50% this year on top of an exceptional performance last year. And while industrial construction spending is expected to be the bright light, healthy gains are expected across the board, with both the commercial and institutional construction categories projected to increase at a double-digit pace (Fig. 1).

“However, after the surge this year, market spending growth is expected to come back to earth in 2024. Forecast panelists are calling for a modest 2% increase in overall building spending next year, with a projected modest decline in the commercial sector, a 4% increase in spending on institutional facilities, and just a 5% increase in the currently red-hot industrial sector.”

A more recent report from AIA, the AIA/Deltek Architecture Billings Index (ABI), which tracks business for architects, said conditions at architecture firms continued to soften in October. For the third consecutive month, the ABI score was under 50 points, indicating that a significant share of firms is seeing a decline in billings. “This report indicates not only a decrease in billings at firms, but also a reduction in the number of clients exploring and committing to new projects, which could potentially impact future billings,” Baker said in the press release. “The soft conditions were evident across the entire country as well as across all major nonresidential building sectors.”

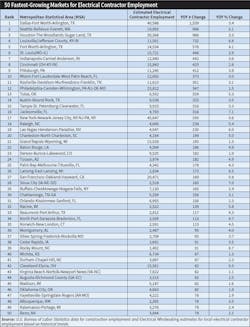

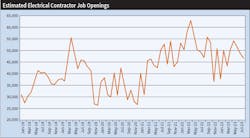

Another good indicator for some insight into the health of the construction market in local market areas is the contractor employment data available from the U.S. Bureau of Labor Statistics (BLS), as shown in Table 2. BLS also provides data on job openings at contractor firms. Even though employment at electrical contracting firms is at near-record levels, contractors are still looking for more employees. According to EC&M estimates using the JOLTS data from the U.S. Bureau of Labor Statistics, electrical contractors had an estimated 32,400 openings for electricians and 46,800 total job openings nationally (Fig. 2).

Small rebound in residential

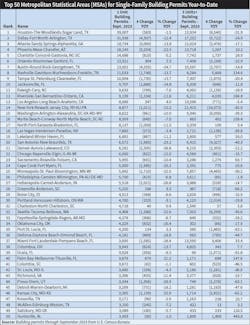

Unless electrical contractors get involved with home construction in some of the hottest housing markets in the country, which tend to be in the Sunbelt and Intermountain states, the residential market may be one of slower business segments in 2024. It probably won’t get much better soon, unless mortgage rates drop to more tolerable levels for first-time homebuyers. Although the National Association of Home Builder (NAHB) expects single-family housing starts to increase 4.6% in 2024 to 946,000 permits after a cumulative decline of 21.2% over the past two years, the recovery is likely to be quite slow in all but the most robust housing markets (Fig. 3). These markets include Houston, Dallas, Atlanta, Phoenix, Charlotte, Orlando, Austin, Nashville, Tampa, and Jacksonville — the nation’s Top 10 housing markets through September 2023 when measured by single-family building permits. Together, these metropolitan areas combined for 102,562 single-family permits (26% of all permits pulled by builders nationwide).

NAHB believes multi-family permits are headed for their second annual double-digit decline in 2024, with a 12.3% drop to 413,000 permits. Through Sept. 2023, the New York metropolitan topped all other markets with 21,415 permits for buildings with five or more units, followed by Dallas, Austin, Houston, Phoenix, Los Angeles, Miami, Atlanta, Washington, D.C., and Nashville (Table 3). Multi-family permits tend to be consolidated in a handful of metropolitan areas, and that was the case again in 2023 — these 10 markets and their 138,750 permits accounted for 35% of all multi-family permits with five units or more through September 2023.

You hear a lot about the potential of vacant urban office buildings being converted into apartments or condos. While this sounds good in theory, these conversions can be quite expensive because of the major upgrades and retrofits often needed for plumbing, HVAC, windows, and other building systems. A November 6 article in The Wall Street Journal said an analysis by www.RentCafe.com showed that in 2022 developers created just 3,575 apartment units in the United States through office conversions — less than 1% of all new apartments built last year.

While the overall residential market may be slow in all but the hottest homebuilding markets, electrical vehicle charging systems will still provide good service business opportunities. In addition, many local markets are supported by enticing utility rebates.

Good times continue to roll in industrial market

For industrially oriented electrical design firms and contractors in the market areas where new semiconductor fab plants, electric vehicle, or EV battery plants are being built, these may one day be remembered as the good old days. Supported in part by truckloads of federal financial incentives mentioned earlier, megaprojects are being built throughout the Midwest, Southeast, Texas, and Arizona. Table 4 highlights several projects that broke ground in the most recent months, including the $2-billion Vinfast EV factory in New Hill, N.C.; the $1.2-billion American Battery Factory plant in Tucson, Ariz.; and the $400-billion ICL EV battery plant in St. Louis. Many more are underway.

Construction of these facilities has powered some truly impressive gains in the Census Department’s construction spending data, with the manufacturing category up 62.5% through September 2023 to $198.5 billion and the computer/electronic/electrical sub-category up 134.9% YOY to $111.1 billion. When you consider that electrical work accounts for 10% of a typical construction project, these trophy jobs will continue to provide plenty of lucrative business for electrical contractors in 2024.

Office construction will be off

The office construction market’s woes caused by the COVID-inspired work-at-home movement are well-known, and the acres of vacant office space in see-through buildings in suburban office parks and downtown office towers aren’t going to get filled anytime soon. While more companies are insisting that employees come to the office at least three days a week, many are still downsizing their office spaces. In many urban areas, office occupancy is hovering around 50%, according to the Kastle Systems Back-to-Work Barometer, which tracks security card swipes in 21,600 buildings throughout 138 cities. Vacancy rates for office buildings are hovering around 16% nationally — a level EC&M editors haven’t seen on the national level in many years.

However, two reasons exist to be optimistic in this market segment. Class A office space (new and in need of a retrofit) is faring better than your basic run-of-the-mill office space. In addition, when companies downsize, and move into smaller spaces, electrical modifications are usually needed.

These blue-chip offices are often outfitted with upscale lighting, VDV, security, and building control networks. The office construction numbers also appear to be headed in the right direction on a macro-level because the Census Department data says private construction spending on new offices year-to-date through September 2023 was up +7.1% YOY to $84.5 billion.

Downtown renovation and live-work-play development

Across America’s suburbs and in many cities, mixed-use construction projects that incorporate multi-family housing, retail construction, and offices are some of the most visible active construction projects. They are called “Live-Work-Play” (LWP) developments because residents can live close to their offices, shop at nearby stores, and enjoy the amenities of restaurants, health clubs, and other services.

A post at www.chainstoreage.com cited a study by www.coworkingcafé.com that said 72 LWP developments were completed or close to completion by year-end 2022, and that 512 LWP communities were built across the United States from 2012 to 2022. One suburban LWP project that broke ground recently is the $2-billion Meridian mixed-use project in Overland Park, Kan., which will feature 4.8 million square feet of office capacity, urban living spaces with 2,000 apartments, two hotels, and retail, restaurant, and entertainment venues.

Hospital construction in good health

Construction of hospitals and medical facilities was up 15.5% in September 2023 to $62.3 billion, according to the U.S. Census Department’s value of construction put-in-place data. Private hospital construction and construction of private medical buildings were up 21% during this time period. Electrical Marketing’s database of construction projects lists 18 hospital projects valued at $100-million or more that entered the planning stage or broke ground in 2023, the largest of which is the $1-billion St. Jude Children’s Research Hospital clinic and office towers that filed for construction permits in February 2023.

Data centers: the gift that keeps on giving

As the use of artificial intelligence (AI) expands, the need for new or upgraded data centers to handle this new application is expected to increase substantially. That’s great news for the electrical market because these facilities are loaded with electrical equipment. In northern Virginia, which has more data centers per square mile than anywhere else in the country, 6.7 million square feet of new data centers are under construction that will need a combined total of 665MW, according to a JLL research report. JLL also says 45 million square feet of data centers are planned in the area, which will require 4,500MW. Electrical Marketing’s editors found 16 data center projects valued at more than $100 million underway or in the planning stages in 2023. At least five of these topped $1 billion in total contract value — the DC BLOX data center campus in Douglasville, Ga; Microsoft data centers in Mount Pleasant, Wis., and Rome, Ga.; and the Prime Data Center campus in Elk Grove Village, Ill.

Schools & universities get decent grades

The long-term potential of educational construction is a bit tougher to analyze than some other segments because of conflicting data. While the Census Department’s data for total educational construction (public/private K-12 and college/universities) shows a 18.8% YOY gain through September 2023 to $118 billion, the long-term national enrollment numbers send out some warning signals about potential future demand. For instance, pre-K to grade 12 public school enrollment is in the middle of a steady decline since 2019 and is expecting to continue dropping through 2030 from a recent high of 50,796,445 to 46,889,642 students (7.7% decline), according to the National Center for Education Statistics (www.nces.ed.gov). While the NCES data for this period doesn’t show a similar decline for enrollment at public colleges and universities, over the next few years this data shows enrollment topping off at about 16.8 million — a 7% decline from the 18-million level it hit in 2010 to 2011.

Despite these forecasts for enrollment declines, plenty of sizable projects are still in the pipeline. The Austin, Texas school district is planning a $2.4-billion modernization; UC San Diego in La Jolla, Calif. broke ground for a $1-billion, 2,400-bed residential village and student center (and is planning a major expansion of its Science Research Park); and Harvard University got financing approved in June 2023 for the first phase of its Enterprise Research Campus in Allston, Mass. — across the Charles River from its main campus.

Renewables ready for more growth

While onshore wind installations are down significantly because of borrowing costs for development loans and supply chain issues, as a whole the renewables industry should be strong. According to the latest data available from American Clean Power (www.cleanpower.org), installation of solar, wind, and battery power increased 13% in 3Q 2023 YOY. American Clean Power said the 5,551MW of utility-scale clean power will be enough to power 813,000 homes.

Both the onshore and offshore segments of the wind industry have hit a rough patch. American Clean Power said only 288MW of onshore wind power was installed through 3Q 2023 — a 77% YOY decline. The U.S. offshore wind industry, which currently only has two installations fully operational, was recently rocked by the news that Orsted (one of the world’s largest offshore wind developers) is pulling out of its 1,100MW Ocean Wind 1 and 1,148MW Ocean Wind 2 projects off the coast of New Jersey. However, you can still expect offshore wind farms to generate some sizable electrical construction work in new port facilities to handle the logistics of shipping equipment out to the wind farms; new factories manufacturing some wind turbine components; and training facilities for wind industry workers. New York will be home to these construction projects as the wind farms off its coast ramp up. In addition, some U.S. shipyards currently have contracts to build specialized ships for transport of materials and crews to the offshore wind farms.

Despite the overall slowdown in wind farm construction, some sizable solar and wind projects are underway. The $813-million Bellefield solar farm and storage battery project in California City, Calif. broke ground in July 2023; Texas will be home to the $540-million Merit Gulfstar solar farm in Wharton County and the $530-million Mockingbird Solar Center in Brookston; and Wyoming has two large wind projects underway (the $738-million Rock Creek wind farm in Laramie and the $525-million Cedar Springs wind farm in Converse County).

Utility market will power sales

The expansion and modernization of the U.S. electrical grid is already huge business. But with the big money flowing into this market segment to meet the demand for more electrical power and to bring new utility-scale renewable resources online, it’s going to get even bigger. New long-distance transmission lines tend to be multi-billion-dollar projects, and the new substations required for utility-scale solar or wind farms or battery storage facilities are also big contracts. The U.S. Census construction data says the new construction in the electric power segment increased 14.8% YOY to $89 billion through September 2023.

Quanta Services, Houston, which focuses on this market segment, is bullish on the future. In a press release announcing Quanta’s most recent financial results, Duke Austin, the company’s president and CEO, said its total backlog at the end of the third quarter reached $30.1 billion (an all-time high for the company) and indicates momentum for 2024. “We are currently pacing ahead of the long-term financial targets articulated at our Investor Day last year and are increasingly comfortable with our ability to achieve them,” he said in the release. “This belief is driven by the long-term programmatic spend of our customers and our confidence that we can capitalize on the energy transition across our portfolio of services, which we believe is in the beginning stages of a multi-decade process.”

While next year’s construction market may call for slower growth, individual market sectors like industrial and data centers and specific regions of the country like the Southwest will do much better than the anticipated low single-digit growth.

About the Author

Jim Lucy

Editor-in-Chief, Electrical Wholesaling & Electrical Marketing

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling, Electrical Marketing newsletter and Electrical Construction & Maintenance magazine on topics such as electric vehicles, solar and wind development, energy-efficient lighting and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas. In 1999, he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in communications and a bachelor’s degree in journalism from Glassboro State College, Glassboro, N.J. (now Rowan University) and studied electrical design at New York University and graphic design at the School for Visual Arts.