The announcement on Feb. 21, 2022, that Tritium, an Australian electric vehicle (EV) charging company, plans to build a factory in Lebanon, Tenn., that will eventually be capable of manufacturing up to 30,000 DC chargers annually, is the latest example of an EV or semiconductor manufacturer with plans to build a massive factory in the United States.

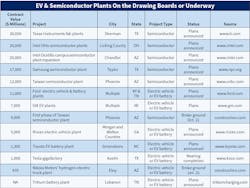

According to Electrical Marketing research, these companies have announced plans for no less than $130.7 billion in facility construction in the coming years to produce electric vehicles, EV charging stations, and semiconductors in the United States (Table). When you consider that electrical construction materials typically account for 10% of a construction job, these plants will provide electrical manufacturers, contractors, distributors, reps, design firms, and other channel partners with a $13 billion-plus market opportunity.

The ground is yet to be broken on most of these facilities, but Tesla is reportedly nearly finished with its $1-billion gigafactory in Austin, Texas, that will produce its Model Y, Model 3 EVs, and eventually its Cybertruck. Tesla’s rivals, Ford and GM, are all in on electric vehicles and, over the past year, announced plans for new plants or expansion of existing facilities. Ford plans to spend $11 billion on new battery plants in Kentucky and Tennessee, and last month, GM announced its intentions to invest $7 billion in a new battery plant in Michigan and retrofit an existing facility in the state to produce electric pickup trucks by 2024.

While the scale of the expected investment in facilities for electric vehicles or battery construction is indeed mammoth, it pales in comparison to what’s going on in the semiconductor market, where Intel, Samsung, Taiwan Semiconductor, and Texas Instruments plan to spend $105 billion on new chip manufacturing plants. The biggest of them all is a $30-billion manufacturing campus Texas Instruments says it will build in Sherman, Texas. Intel made headlines last month when it announced that it would be spending $20 billion on greenfield semiconductor plants in Licking County, Ohio. The company is also spending $20 billion on an existing facility in Chandler, Ariz.

The EV and semiconductor industries will be able to tap into several financial and government incentives to fuel some of this growth. The Infrastructure Investment and Jobs Act (IIJA) passed late last year includes $7.5 billion to assist in the construction of a national EV charging network; a surprising number of electric utilities are offering a robust mix of rebates for the installation of commercial and residential EV chargers, and both the Senate and House of Representatives have passed bills with federal subsidies for domestic semiconductor production.

The House of Representatives passed the America Creating Opportunities for Manufacturing Pre-Eminence in Technology and Economic Strength (America COMPETES) Act of 2022 on Feb. 4, 2022, which will provide $52 billion in federal subsidies. On June 8, 2021, the Senate passed the U.S. Innovation and Competition Act of 2021, which includes the same level of funding for that goal. Once the Senate and House hammer out their differences on the legislation, it’s expected to gain enough bipartisan support to be signed into law.

About the Author

Jim Lucy

Editor-in-Chief, Electrical Wholesaling & Electrical Marketing

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling, Electrical Marketing newsletter and Electrical Construction & Maintenance magazine on topics such as electric vehicles, solar and wind development, energy-efficient lighting and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas. In 1999, he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in communications and a bachelor’s degree in journalism from Glassboro State College, Glassboro, N.J. (now Rowan University) and studied electrical design at New York University and graphic design at the School for Visual Arts.