Engineering and Construction Costs Rise in August

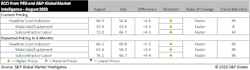

Engineering and construction costs increased again in August, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, an indicator measuring wage and material inflation for the engineering, procurement, and construction sector, increased to 60.4 this month from 56.8 in July, indicating that price increases were slightly more widespread than last month. The sub-indicator for materials and equipment costs saw a minor increase to 55.9 this month from 52.6 in July; price pressures have remained strong since the December sub-50 reading. The sub-indicator for subcontractor labor costs increased modestly to 71.0 this month, up from 66.7 in July.

The equipment and materials indicator continued to show rising prices, though only six of the twelve components posted increases in August. The categories for carbon steel pipe, alloy steel pipe, and shell and tube heat exchangers were in contractionary territory this month with values between 33.3 and 40.0. Fabricated structural steel remained neutral with a value of 50. Meanwhile, global trade categories shifted from contractionary to neutral in August for ocean freight prices on Europe-to-U.S. and Asia-to-U.S. routes. Readings for transformers and electrical equipment components rose to 71.4 and 85.7, respectively.

“The supply constraints that first emerged for electrical steel in 2022 remain and are impacting costs for construction and engineering projects,” said John Anton, Economics Director, S&P Global Market Intelligence. “We expect recent events, including the proposed merger of U.S. Steel and Cliffs and the announced duties on imports of steel from mainland China to Mexico to keep prices of electrical steel elevated.”

The sub-indicator for current subcontractor labor costs increased this month, registering 71.0 in August after a 66.7 reading in July; this represents a second month of moderately strong readings after a few months of tepid growth in the second quarter. While labor markets are not as tight as they were in 2022, a reading of 71.0 indicates that costs continue to rise. According to survey responses, labor costs are tightest in the U.S. Northeast and South regions and weakest in Eastern Canada.

The six-month headline expectations for future construction costs indicator increased by 5.2 points to a reading of 66.1 in August. The six-month expectations indicator for materials and equipment came in at 61.8, 3.4 points higher than last month’s figure. The outlooks for carbon steel pipe and alloy steel pipe remained in contractionary territory this month while shell and tube heat exchangers, gas/steam turbines and pumps and compressors returned to expansion. Expectations for fabricated structural steel stayed flat at neutral this month. Transformers and electrical equipment rebounded to very strong readings of 85.7, but ready-mix concrete stayed on top with a second straight month registering 100, indicating all respondents expect higher prices in six months.

The six-month expectations indicator for sub-contractor labor increased compared to last month, up 9.4 points to a reading of 76.1. Increases occurred in every category and region of the U.S., but results were mixed in Canada. Eastern Canada remains in neutral territory at 50.0 whereas Western Canada saw categories move in opposing directions, settling at 66.7. The tightest regions are the U.S. South and West where values sit at 83.3.

Respondents reported no specific material shortages in August, but did note that labor issues remain, causing tightness in certain markets.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, visit S&P Global Market Intelligence/s website.