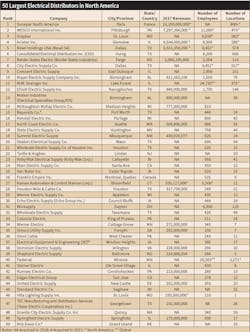

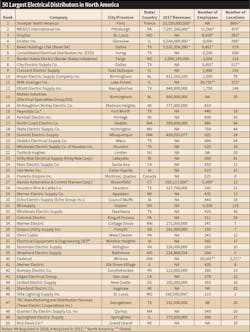

The 50 Largest Electrical Distributors

If you see some familiar names in the ranking of the 50 Largest Electrical Distributors in North America below, some of the distributor branches your company’s employees stop by for supplies on the way to job sites on many mornings may be part of much bigger organizations than you thought.

The size of many of the companies in this ranking, published annually by the editors of Electrical Wholesaling, EC&M’s sister publication, may surprise you. You have five full-line electrical distributors with a national focus — Sonepar North America, Charleston, S.C.; WESCO International, Pittsburgh, Pa; Graybar Electric Co., St. Louis; Rexel USA, Dallas; and Consolidated Electrical Distributors (CED), Irving, Texas, that together account for at least 33% of the $100 billion in supplies sold through distributors of electrical supplies. Two of these companies — Sonepar and Rexel — have a truly global focus, as together they operate a combined total of 4,812 branches in dozens of countries around the world.

The rest of the 10 largest distributors on this list each do close to or more than $1 billion in sales annually, and they individually each have a higher individual sales volume than many of the electrical manufacturers whose products they sell. And while many of the billion-dollar distributors are acquiring smaller distributors to expand into new markets, according to EW’s data, 70 other full-line electrical distributors or specialty distributors focused on wire and cable, utility products, or lighting equipment did at least $100 million in sales in 2017.

When it comes to electrical distributors, bigger isn’t necessarily better, because comparatively small electrical supply houses can compete quite well with the giants if they do a better job of focusing on the basics of stellar customer service — providing the right product, at the right time and place, and at a competitive price. Smaller distributors also often enjoy the advantage of having veteran employees in local markets who have relationships with customers that go back for many years. In contrast, the larger companies often use local markets as training grounds for employees, and their most highly motivated employees are often promoted to posts outside the local market at the regional or national level. On the flip side, larger distributors offer more financial resources than smaller competitors, and they can use this money to fund branch expansion, employee training, online storefronts, and other internal investments.

Distributors of all sizes are bullish about market conditions this year, and they will someday remember the past two years as the good old days. Many of the nation’s largest metropolitan areas have plenty of construction projects to keep people happy. The federal tax cuts are being received well, even if the impact on customers’ capital spending isn’t always immediately obvious. And although the industrial market can’t match the growth of the commercial and institutional construction segments, some large auto-related projects are either on the drawing boards or in the early stages of development. The retrofit of existing industrial facilities with LED lighting is providing some nice business, too.

As a group, the 100 distributors who provided a 2018 sales forecast for Electrical Wholesaling’s Top 200 ranking are looking for 7.5% growth in 2018, which is at the high end of the electrical wholesaling industry’s historical annual growth range of 4% to 8%. A surprising 30% of those distributors expect double-digit growth this year. Many of the companies looking at 10%-plus growth are basing their expectations on new market niches or services.

Art Cook, president, Buckles-Smith, Santa Clara, Calif., is also quite bullish for 2018. His forecast for +25% growth is based largely on the company’s new focus on servicing commercial contractors on multi-tenant housing and commercial office space projects. At No. 62 on EW’s Top 200 list with $147 million in annual sales, few companies have moved up the ranking as fast as Lonestar Electric Supply, Houston, which started up in May 2015. The company opened a new branch in Austin, Texas, last month, and CEO Jeff Metzler is forecasting a 15% sales increase this year.

LED lighting continues to be a growth segment for the Top 200. Steve Byrne, COO of Facility Solutions’ Austin, Texas-based lighting group is seeing the most growth in large-scale lighting renovations of existing facilities by property management firms, and he said the hospitality and finance and banking segments are currently providing the most opportunities for Facility Solutions’ package of lighting supply and related services.

If you would like to learn more about what’s happening with these key players in the electrical supply chain, check out Electrical Wholesaling’s 2018 Top 200 Electrical Distributors at ewweb.com.

About the Author

Jim Lucy

Editor-in-Chief, Electrical Wholesaling & Electrical Marketing

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling, Electrical Marketing newsletter and Electrical Construction & Maintenance magazine on topics such as electric vehicles, solar and wind development, energy-efficient lighting and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas. In 1999, he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in communications and a bachelor’s degree in journalism from Glassboro State College, Glassboro, N.J. (now Rowan University) and studied electrical design at New York University and graphic design at the School for Visual Arts.